A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. The three statement model provides a simple template to forecast the three financial statements over the next 5 years. 4 Operating Models Delivering on strategy and optimizing processes While an operating model is not the strategy itself it does help refine and reinforce it. 3 Statement Model Case Study Video Tutorial 30 Minute Time Limit In this tutorial youll learn how to complete a three-statement modeling case study for an industrials company Illinois Tool Works under extreme time pressure 30 minutes and youll get the key tips tricks mistakes to avoid and suggested completion order. - 3-Statement Operating Model. For investment banking specifically these types of case studies are most common. Once the initial case is built it is useful to see using either equity research management guidance or other assumptions how the forecasts change given changes in a variety of key model assumptions. The model will begin by using historical data and ratios and forecasted ratios and projectionstopics that we have already begun to discuss previouslyand will tie in the building of the rest of the complete operating model. Add to wish list. Three statement projections models can often be overly complex with too many inputs and too many tabs.

View IBIG-06-03-Three-Statements-90-Minutes-Completexlsx from ECONOMICS 1002 at Queens University. The model will begin by using historical data and ratios and forecasted ratios and projectionstopics that we have already begun to discuss previouslyand will tie in the building of the rest of the complete operating model. Model or collection of models maps tables and charts that explains how the organisation operates so as to deliver value to its customers or beneficiaries In its simplest form an operating model is a value delivery chain. For simplicity the models do not include capital expenses depreciation or inventory management though they can be added by a power user. For investment banking specifically these types of case studies are most common. Easier to navigate dont have to switch between tabs. The Macabacus operating model implements key accounting and tax concepts and is a foundational building block for our merger and LBO models. Financing events such as issuing debt affect all three statements in the following way. - 3-Statement Operating Model. What is a 3 statement model.

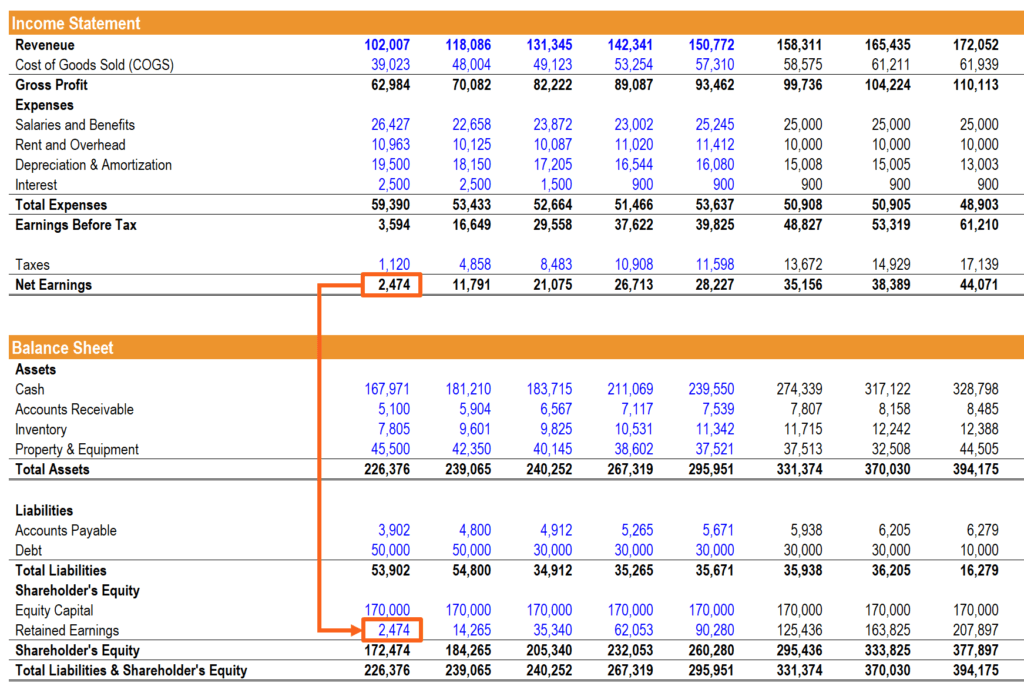

The 3 statement model template is the foundation on which more advanced financial models are built such as discounted cash flow DCF models mergers models leveraged buyout LBO models and various other types of financial models. As the head of the Financial Modeling Group at SP Global Market Intelligence my team has built over 15000 models for our clients and simplicity is the key to client satisfaction. Add to wish list. Among other things an operating model determines behavior workflow and process design IT decisions and investment decisions. It is the foundation upon which all thorough financial analysis is built. For simplicity the models do not include capital expenses depreciation or inventory management though they can be added by a power user. Three statement projections models can often be overly complex with too many inputs and too many tabs. There are many misconceptions about what an operating model. The interest expense appears on the income statement the principal amount of debt owed sits on the balance sheet and the change in the principal amount owed is reflected on the cash from financing section of. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model.

Financing events such as issuing debt affect all three statements in the following way. When a companys operating model is inconsistent with the broader objectives of the business that misalignment affects the day-to-day actions of individual employees and ultimately creates an insurmountable gap between strategy and execution. The interest expense appears on the income statement the principal amount of debt owed sits on the balance sheet and the change in the principal amount owed is reflected on the cash from financing section of. A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Among other things an operating model determines behavior workflow and process design IT decisions and investment decisions. As the head of the Financial Modeling Group at SP Global Market Intelligence my team has built over 15000 models for our clients and simplicity is the key to client satisfaction. Similarly while it is not the operational instructions it does help guide them. The three statement model provides a simple template to forecast the three financial statements over the next 5 years. A sequence of steps that describe the main work of the organisation. This video will follow the procedure outlined in the previous video titled Overview of the Process but the model built will be far more thorough.

3-Statement Models You might receive a companys financial statements in Excel and then get 20-30 minutes up to 2-3 hours depending on the complexity to build a 3-statement projection model for the company. Model or collection of models maps tables and charts that explains how the organisation operates so as to deliver value to its customers or beneficiaries In its simplest form an operating model is a value delivery chain. This is an Excel Model and FREE to Download. 4 Operating Models Delivering on strategy and optimizing processes While an operating model is not the strategy itself it does help refine and reinforce it. - 3-Statement Operating Model. When a companys operating model is inconsistent with the broader objectives of the business that misalignment affects the day-to-day actions of individual employees and ultimately creates an insurmountable gap between strategy and execution. 3 Statement Model Case Study Video Tutorial 30 Minute Time Limit In this tutorial youll learn how to complete a three-statement modeling case study for an industrials company Illinois Tool Works under extreme time pressure 30 minutes and youll get the key tips tricks mistakes to avoid and suggested completion order. As the head of the Financial Modeling Group at SP Global Market Intelligence my team has built over 15000 models for our clients and simplicity is the key to client satisfaction. Once the initial case is built it is useful to see using either equity research management guidance or other assumptions how the forecasts change given changes in a variety of key model assumptions. The purpose of building a 3-statement financial model is to observe how various operating financing and investing assumptions impact a companys forecasts.