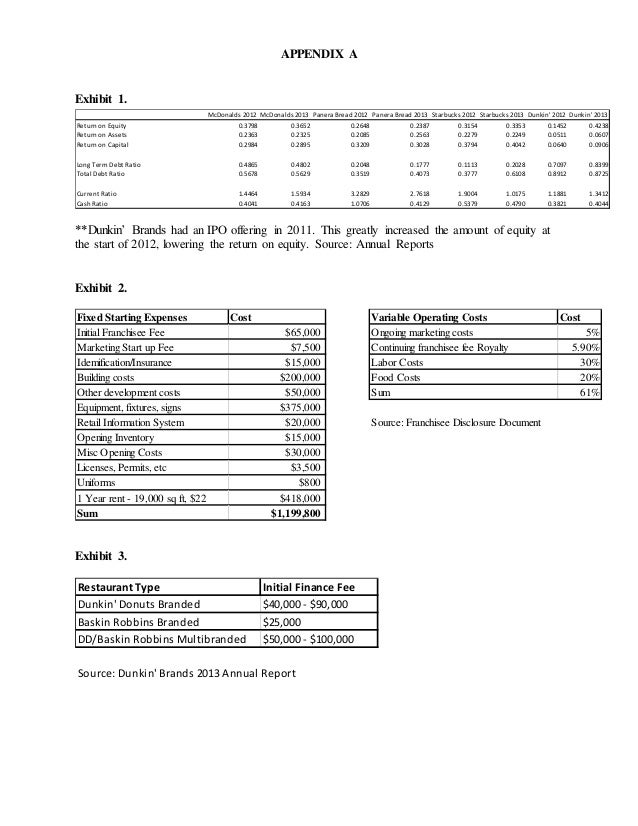

-1 between the first and the second quartile. Current AssetsCurrent Liabilities extent to which a firm can meet short-term obligations - generally one wants an upward trend Quick Ratios. Dunkin Brands Key Financial Ratios Generally speaking Dunkin Brands financial ratios allow both analysts and investors to convert raw data from Dunkin Brands financial statements into concise actionable information that can be used to evaluate the performance of Dunkin Brands over time and compare it to other companies across industries. 2020 was -641. Panera Bread and Starbucks are at35-40 and37-61 respectively. Dunkin Donuts C Growth Strategy Financial analysis is the assessment of the stability viability as well as profitability of a sub-business business or project. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile. 1 between the second and the third quartile. The NA ratio of Dunkin Brands Group Inc. Revenues reflect DunkinDonuts US.

40735800 - Other Operating Expenses 432535 436631 RevenueExpense 488--Cost of Sales percentage change-094--Operating Profit percentage change 1120--Net Income percentage change 2005--Current Ratio. Netincome decreased 12 to 1625M. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile. Visit DNKNs Balance sheet. Debt to equity ratio. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio value. 2020 was -641. DNKN Financial Summary For the 39 weeks ended 26 September 2020 DunkinBrands Group Inc revenues decreased 6 to 9721M. -1 between the first and the second quartile. Dunkin Brands Group Inc s Total Liabilities.

1 between the second and the third quartile. Revenues reflect DunkinDonuts US. Starbucks has a larger footprint with over 30000 locations worldwide. 0 the ratio value deviates from the median by no more than 5 of the difference between the median and the quartile closest to the ratio value. DNKN Financial Summary For the 39 weeks ended 26 September 2020 DunkinBrands Group Inc revenues decreased 6 to 9721M. Visit DNKNs Balance sheet. The NA ratio of Dunkin Brands Group Inc. Dunkin Brands Group Inc s Equity -533 Millions. Each ratio value is given a score ranging from -2 and 2 depending on its position relative to the quartiles -2 below the first quartile. Dunkin Brands Key Financial Ratios Generally speaking Dunkin Brands financial ratios allow both analysts and investors to convert raw data from Dunkin Brands financial statements into concise actionable information that can be used to evaluate the performance of Dunkin Brands over time and compare it to other companies across industries.

Microsoft Corporation Common Stock. Panera Bread and Starbucks are at35-40 and37-61 respectively. In the fiscal year 2019 ROA detoriated to 617 despite annual net income growth of 527 to 24202 millions from 22991 millions a year ago as DNKNs assets increase to 392002 millions by 527. More Return On Equity Ratios Restaurants Industry Return On Asstes Trends and Statistics Services Sector Roa Statistics. Starbucks generates over 26 billion a year in revenue while Dunkin Brands annual revenues are just under 15 billion. 2020 was -641. Financial Analysis Dunkin Donuts Company Summary 2014 Market Cap 39 Billion Shares Outstanding 104630978 shares Earnings Per Share 165 Current Dividend Price 106 Dividend Yield 249 PE Ratio 2546 Return on Equity 4793 Current Stock Price 4260 Introduction Dunkin Donuts is the Worlds Leading Franchisors of Quick Service Restaurants QSRs. Visit DNKNs Balance sheet. Current AssetsCurrent Liabilities extent to which a firm can meet short-term obligations - generally one wants an upward trend Quick Ratios. Dunkin Brands Group Inc s Total Liabilities.

Panera Bread and Starbucks are at35-40 and37-61 respectively. Financial analysts and individual investors use PE Ratio and PEG ratios to determine the financial performance of a business. Dunkin Brands Groups debt to equity for the quarter that ended in Sep. Netincome decreased 12 to 1625M. This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Dunkin Brands Group Incs. Is significantly lower than the average of its sector Restaurants Bars. Visit DNKNs Balance sheet. Debt to equity ratio. DNKN Financial Summary For the 39 weeks ended 26 September 2020 DunkinBrands Group Inc revenues decreased 6 to 9721M. Dunkin Donuts only has the better gross.